In the time period between November 2021 and the present, Tesla CEO Elon Musk has lost an estimated $182 billion (another estimate puts it closer to $200 billion), setting a new record for the largest loss of a personal fortune in history. But Silicon Valley insiders say he could see a major turnaround this year, and it would be due to one of his other companies, SpaceX.

Two of these insiders are Jason Calacanis and Chamath Palihapitiya, both of whom are well-known venture capitalists in the Bay Area. Palihapitiya was once dubbed “SPAC King” for his extensive portfolio of special purpose acquisition companies. Both have worked closely with Musk for years, and they discussed their expectations for 2023 on the All-In podcast.

Text messages between Calacanis and Musk, including an oath of fealty reading “Board member, adviser, whatever…you have my sword. “, were made public as part of the Twitter acquisition lawsuit, revealing the closeness of the two men. Coach, put me in the action! To be the CEO of Twitter would be a lifelong dream come true. They are probably biassed in Musk’s favour, but they do see a clear path for the world’s second-richest man to regain his swagger in 2023.

Also Read: What is Elon Musk being investigated for

Pricing Starlink

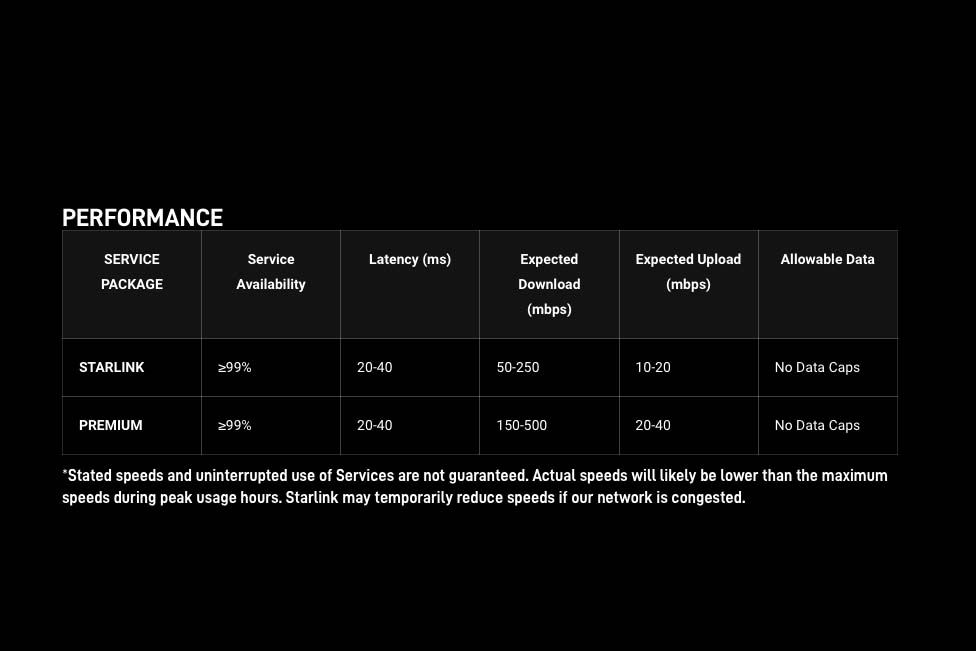

SpaceX, the industry leader in commercial space launch, has a satellite-broadband division called Starlink. It rose to prominence last year as a result of the conflict in Ukraine, where its user terminals were instrumental in the resistance to Russia’s invasion by allowing troops to maintain contact with each other and with Kyiv despite the attacks on infrastructure.

According to Palihapitiya, “at least half of SpaceX’s current private worth” will be placed on Starlink. Calacanis, the show’s host, calculated that this would equal about $75 billion. Midway through November, Bloomberg reported that SpaceX was negotiating a funding round that would give the company a valuation of more than $150 billion.

After cash flow could be predicted “reasonably well,” Musk said in early 2021, “Starlink will go public.” I think it’s going public, and I think it’s going to be the best chance we have of opening up the capital markets in 2023,” Palihapitiya said on the podcast. This week’s issue of Fortune’s Term Sheet newsletter noted that “the American IPO market was basically dead last year.”

Also Read: Ex-Twitter execs to testify in Congress on handling of Hunter Biden laptop reporting

Space for oysters to “breathe”

To paraphrase what Elon said on our pod, “I think it’s because Elon has the complete financial flexibility to do what he needs to do and — he talked about this on our pod, the difficulties and dangers of margin loans and all those About things — he’s going to create breathing room for himself. It’s the quickest and clearest path for him to take. He’ll have a lot more ammunition as a result.

To pay off some of the higher-interest loans from his Twitter deal, Bloomberg reported in early December that Musk’s bankers were considering giving him new margin loans backed by Tesla stock. Then, Musk put in billions of his own money to buy Twitter, in part by selling Tesla stock.

While discussing the economy on a podcast last month, Musk said, “I would really advise people not to have margin debt in a volatile stock market and, you know, from a cash perspective.” Avoid having wet powder around. The down market has some very high-end items for sale.

The Trust Factor is a weekly newsletter that explores what leaders need to succeed, and it can teach you how to navigate and strengthen trust in your business.

Also Read: Why Twitter users are upset about the platform’s latest change