(Reuters) – SHANGHAI The United States has made the development of China’s semiconductor industry a top priority, placing export restrictions on key components of China’s chip sector supply chain in an effort to stifle the country’s technological development.

Beijing has invested heavily in developing a homegrown chip industry, but the fabs that turn silicon wafers into chips that run electronics continue to rely heavily on imported machinery.

Also Read: India Adopts New Android OEM Rules Revenue Sharing should replace “Requirements”

COMPANY ENGAGED IN GLOBAL SEMICONDUCTOR MANUFACTURING (SMIC)

The chips produced by SMIC, China’s largest fab, are used in a wide variety of automobiles, IoT devices, and mobile phones. Since its founding in 2000 with support from the Shanghai government, the company has been positioning itself as China’s answer to Taiwan’s Semiconductor Manufacturing Co Ltd (TSMC), despite being technologically and financially inferior. Apple Inc. and Nvidia Corp. are two of TSMC’s many high-profile customers.

The United States recognised its government support and aspirations to produce high-end chips, and added the company to its Entity List in 2020. SMIC’s plans to acquire Extreme Ultraviolet lithography machines from the Dutch company ASML Holding AS were effectively derailed by the placement.

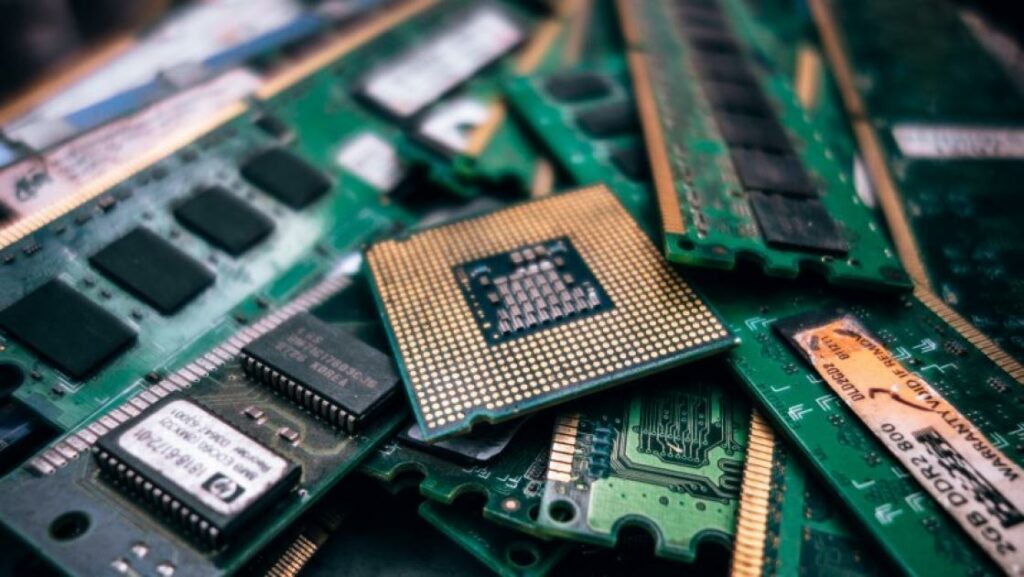

The 45 nm process node and higher accounts for the vast majority of SMIC’s current sales. Due to a worldwide shortage of lower-end chips in late 2020, this specialisation in older chips has proven to be very successful. Even so, its sales and R&D expenditure continue to lag far behind those of TSMC, and its global market share in the pure-play foundry sector remains in the single digits.

Also Read: VR Firm Pico, Owned By TikTok Parent ByteDance, Announces ‘Small’ Layoffs

Shocking the industry, the company produced a chip in 2022 that appeared to share characteristics with TSMC’s 7 nanometer process node technology, all without using ASML machinery. While its breakthrough was widely celebrated, its long-term viability was questioned by experts. No response from SMIC has been provided to the findings.

“HUA HONG SEMICONDUCTOR CO., LTD.”

China’s second-largest fab is Hua Hong Semiconductor Ltd. The company, which has been around since 1996, focuses on producing chips at the 55 nanometer process node and above and is considered a leader in this field.

The company is behind in the production of cutting-edge nodes because it has allocated fewer resources to this area than SMIC. In 2023, the company intends to hold another IPO and start construction on a new fab in Wuxi, located in the country’s eastern region.

Also Read: MediaTek Helio G36 SoC for Budget Smartphones Introduced

As a company, YANGTZE MEMORY TECHNOLOGIES CO LTD (YMTC)

YMTC is the sole Chinese company competing in the international NAND memory market, which has been dominated for decades by a small group of American and Korean companies. It was admitted to the U.S. Entity List last year and is responsible for chip design and production.

Despite the fact that YMTC holds only a marginal share of the industry as a whole, analysts have noted the company’s gradual integration into the Chinese supply chain and the improvement in the quality and affordability of its offerings.

Also Read: Silicon Valley Honchos Say it’s India’s Turn To Shine

Last year, the company introduced a chip with 232 layers of memory cells, bringing it closer to competitors like Samsung Electronics Co Ltd of South Korea. Limits on the export of necessary equipment, according to experts, could scuttle future efforts.

YMTC began as a subsidiary of Tsinghua Unigroup, a chip conglomerate, before it was established in 2016 with funding from the Wuhan government and the China National Integrated Circuit Industry Investment Fund. When its parent company restructured in anticipation of bankruptcy, it was spun off.

Also Read: Biden Hammers Big Tech, Tweaks Cable in State of the Union

Memory Technologies by CHANGXIN (CXMT)

DRAM chips, like NAND memory, have been manufactured primarily by a small group of companies in the United States, South Korea, and Taiwan for quite some time, but CXMT is China’s only major player in this field.

The company currently has one fab up and running, with plans to construct two more. It currently manufactures DRAM at the 19 nm process node and is transitioning to the 17 nm node, both of which are several process nodes behind the cutting edge of the industry.

According to Trendforce, export restrictions placed on equipment in October could have an effect on growth strategies.

Also Read: Baidu to complete the testing of its ChatGPT rival in March